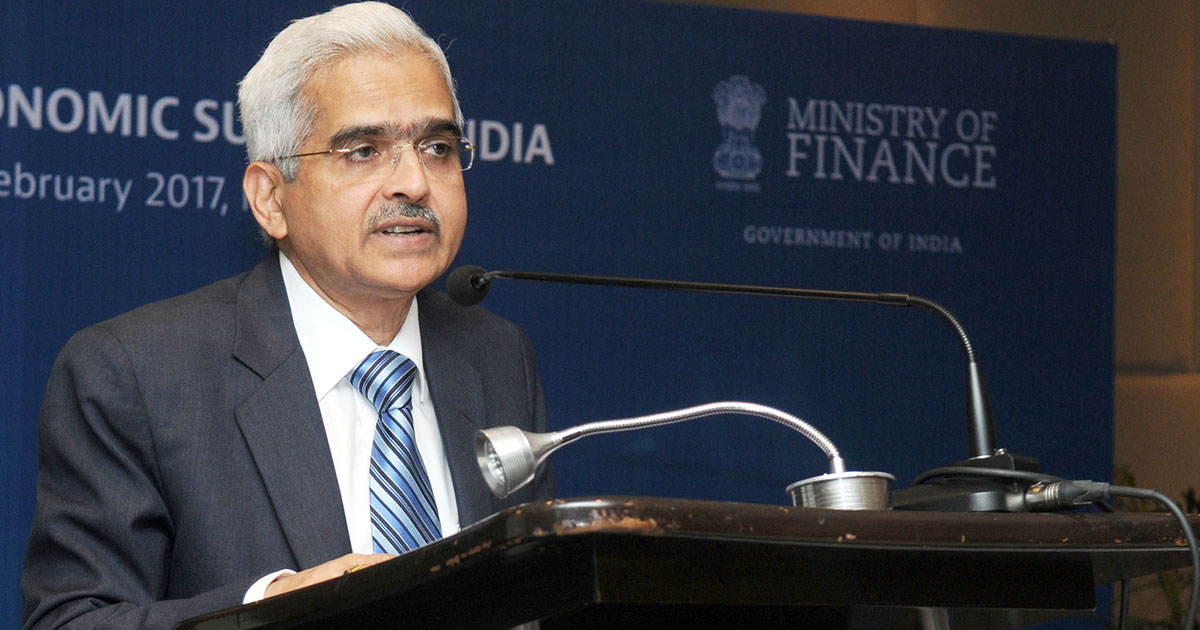

RBI Governor Das: Increased risk weight is a precautionary approach to ensuring sustainable lending

23 Nov 2023

Reserve Bank of India (RBI) Governor Shaktikanta Das said that the recent instruction to increase risk weights for unsecured consumer loans by banks and non-banking financial companies (NBFC) is a cautious measure taken to ensure sustainable lending.

RBI Governor Das stated that they had recently announced several macro-prudential measures in the overall interest of sustainability. He mentioned that these measures were pre-emptive in nature and were calibrated and targeted.

He also added that major growth drivers like housing, vehicles, and MSME loans are excluded from these norms by the central bank.

Shaktikanta Das was the keynote speaker at the FIBAC 2023 Conference, which is jointly organized by the Federation of Indian Chambers of Commerce and Industry (FICCI) and the Indian Banks’ Association (IBA).

The RBI emphasizes the enhancement of governance and assurance functions, effective risk management, and robust lending practices. It's important to note that this measure is not a "value judgment" on banks or their underwriting. Nevertheless, banks and NBFCs should engage in reflection and introspection to identify potential sources of risk. They should reinforce their risk management practices, conduct stress tests on their balance sheets, and establish additional buffers.

Das mentioned that while credit growth is accelerating in the current period, banks and NBFCs should take due care to ensure that credit growth at the overall, sectoral, and sub-sectoral levels remains sustainable and all forms of exuberance are avoided.

Additionally, lenders must reinforce their asset liability management and pay increased attention to their liabilities. This is particularly crucial due to the heightened dependence on high-cost, short-term bulk deposits, especially considering the elongated tenure of both retail and corporate loans.

The heightened interconnectedness between banks and NBFCs demands careful attention, as noted by Das. He emphasized the potential contagion risk resulting from such "concentrated linkages." Accordingly, banks should consistently assess their exposure to NBFCs and the exposure of individual NBFCs to multiple banks. In response, NBFCs should concentrate on diversifying their funding sources and reducing their reliance on bank funding.

Addressing fintech partnerships and model-based lending through analytics, Das cautioned lenders against solely relying on pre-set algorithms and models. He stressed the importance of ensuring the robustness and periodic testing of these algorithms and models. This precaution is essential to guard against any undue risk accumulation in the system caused by information gaps in these models, which could lead to a dilution of underwriting standards.

Furthermore, Das highlighted that, following the deregulation of rates for microfinance institutions (NBFC-MFIs), certain entities "appear to be enjoying relatively higher net interest margins."

He mentioned that it is indeed the responsibility of microfinance lenders to ensure that the flexibility provided to them in setting interest rates is used judiciously. They are expected to ensure that interest rates are transparent and not outrageous.